Agentic AI built for

IT Financial Management.

Not a chatbot. Not a feature layer.

A domain-aware agent framework embedded directly into the financial operating system.

Yarken is redefining how ITFM and TBM platforms think, reason, and act—within governance, at enterprise scale.

Built into the core of Yarken

Agentic AI is not layered on top of Yarken. It is embedded into how the platform reasons about financial structure, evaluates change, and supports execution.

At the foundation is Yarken’s governed cost model—where services, applications, vendors, business units, and allocations are defined with clear relationships and constraints. Agents operate within that model, using its structure as context for every interpretation and action.

Across planning, forecasting, cloud optimization, contract value management, TCO modeling, and financial reporting, the agentic framework:

Identifies material drivers behind cost movement

Evaluates downstream impacts before proposing action

Prepares structured, policy-aligned execution paths

As environments evolve—new services, vendors, pricing models, or demand shifts—the system adapts within the same governed framework. Intelligence increases without sacrificing consistency or control.

Operational Intelligence, Enterprise-Ready

Financial visibility is no longer enough. Enterprises need systems that can interpret change, act responsibly, and scale with complexity, without compromising control. This section details how Yarken delivers that shift.

Engineered for financial control environments

Enterprise IT finance operates under constraints: approvals, ownership boundaries, audit requirements, close cycles, and policy rules.

Yarken’s agentic framework is built with these realities in mind.

Agents operate within:

-

Role-aware permission models

-

Defined financial guardrails

-

Transparent allocation logic

-

Traceable decision paths

-

Structured approval patterns

Every recommendation and action can be:

-

Explained

-

Reconstructed

-

Audited

-

Aligned to policy

This ensures intelligence never outruns governance.

Moving ITFM from analysis to operational intelligence

ITFM and TBM platforms have traditionally focused on visibility and reporting.

Agentic AI enables something more powerful: operational intelligence.

Instead of waiting for periodic review cycles, the system can:

-

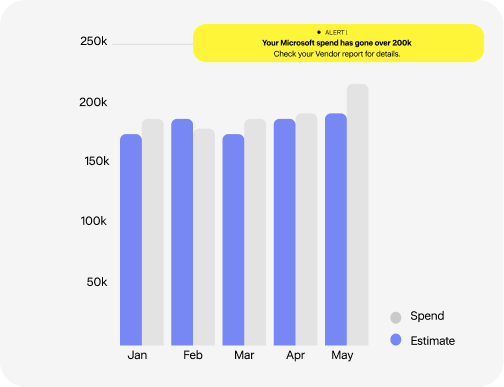

Continuously monitor cost and usage signals

-

Surface material deviations automatically

-

Assess sensitivity and exposure

-

Prepare corrective workflows

-

Coordinate across financial and operational stakeholders

This shortens the distance between insight and outcome—while keeping accountability intact

Designed for enterprise scale

Yarken’s agentic framework is built to operate across:

-

Multi-cloud environments

-

Hybrid infrastructure

-

Complex shared service structures

-

Global financial entities

-

High-volume transactional data

It scales with organizational complexity because it operates within structured financial models—not loose heuristics.

Domain intelligence, combined with governed structure, allows the system to support both granular operational questions and executive-level financial decisions

Defining the next generation of ITFM platforms

The next generation of IT financial management platforms will not be defined by dashboards or static reports.

They will be defined by systems that:

-

Understand financial architecture

-

Reason about change

-

Act within enterprise constraints

-

Learn continuously

-

Support coordinated execution

Yarken is building that generation.

Agentic AI inside Yarken is not experimentation.

It is a structured, domain-aware evolution of how ITFM and TBM platforms operate.

Business Unit Consumption

Precise business unit metrics allow showback and chargeback of cost to the service consumers

Cloud

Cost

Efficiently normalize and manage spend across multiple cloud providers

On-Prem Infrastructure

Supplement cloud costs with On-Prem infrastructure costs to get a holistic view

Unit Economics

Ensure and demonstrate the effectiveness of your services with precise unit metrics